AuditShark COB

The AI Platform for COB

Smart Automation. Maximum Savings. Ultimate Efficiency.

CHALLENGES BY LINES OF BUSINESS

CMS is often forced to rely on bad coverage data from commercial plans, leading to Garbage In Garbage Out problems downstream. They often over-estimate MSP rates. This leads to reduced MA premiums, and claims paid at commercial rates. Leverage AuditShark COB to reduce MSP rates, maximize MA premiums, and reconcile months of missed premiums.

As the payer of last resort, Medicaid plans suffer the most from bad COB data. State Medicaid Departments issue notoriously low accuracy TPL files, which are often the only lead source available for MCOs and Medicaid plans. Medicaid plans gain the most from a modern Coordination of Benefits (COB) operation.

Coverage dependence changes frequently and is often difficult to verify, usually requiring time-consuming phone calls for confirmation. Each state can have different rules and regulations regarding how Coordination of Benefits (COB) can be used and when, which can make it hard to scale across stateliness.

OUR SOLUTION

AuditShark COB is the first and only platform to offer a fully automated, end-to-end approach to Coordination of Benefits. Purpose-built for health plans, our platform enables internal teams to maximize efficiency, increase hit rates, drastically boost cost avoidance while reducing the cost of recovery.

Get the MOST out of your COB team.

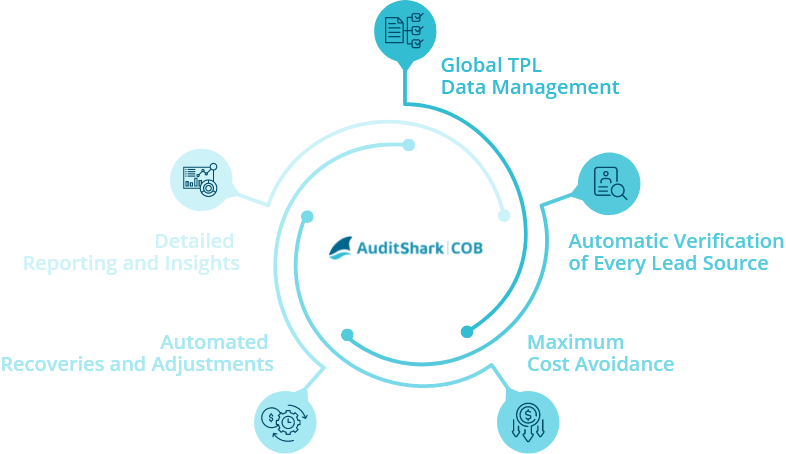

SOLUTION FEATURES

-

Global TPL Data Management

Access EVERY Lead Source and then leverage them in order of quality, accuracy and cost -

Automatic Verification of Every Lead Source

Hang up the phone and let AuditShark do the verification for you -

Maximum Cost Avoidance

Pay claims right the first time with the most up to date, accurate, verified, OHI and COB information at the point of adjudication -

Automated Recoveries and Adjustments

Analyze and Verify Overpayments, initiate letters, and make adjustments all with an automated platform -

Prioritized Work Queues

Experience a 100% hit rate on recoveries and rank work queues in order of financial impact -

Detailed Reporting and Insights

Easily track and report ROI, lead source accuracy, per user efficiency and over 120 other KPIs

Get the MOST out of your CAQH Data.

We believe you shouldn’t have to work hard to get value from your COB data sources.Instead, those data sources should work for you!

AuditShark COB is pre-integrated with CAQH’s comprehensive registry of member coverage data, which delivers a seamless, end-to-end solution for the entire COB life cycle and for all CAQH customers and users. Maximize the value of all of your COB Data sources and let AuditShark scrub, analyze, verify, and automate COB leads. Streamline the entire lead generation process and automate recovery efforts for unmatched efficiency and maximum ROI. Easily track, measure and report ROI.

SOLUTION BENEFITS

-

-

Maximum Automation and Efficiency:

Eliminate legacy administrative workflows and reduce administrative costs

-

-

Clear and Demonstrable Return on Investment (ROI):

Track and measure every aspect of the COB process to ensure value at every step

-

-

Maximum Cost Avoidance and Savings:

Ensure payment accuracy, reduce rework, and increase total COB savings

-

-

Enhanced Compliance:

Easily pass COB Audits and Ensure Payment Accuracy and Timely Recoveries

With AuditShark COB

Health Plans can experience

-

-

Maximum

Cost Avoidance

-

-

Effortless

Recovery