OUR SOLUTION

The One-Stop Audit Solution

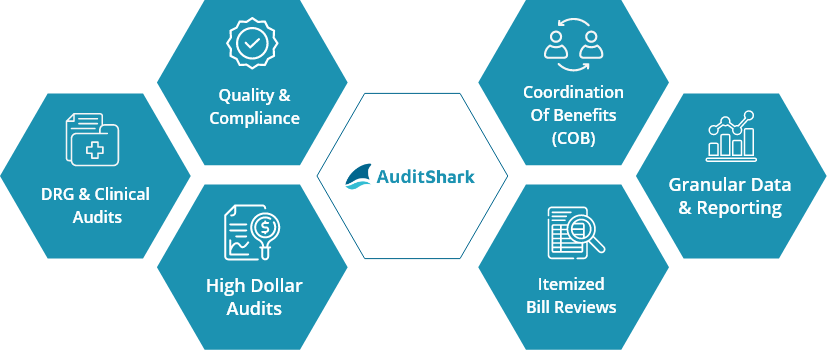

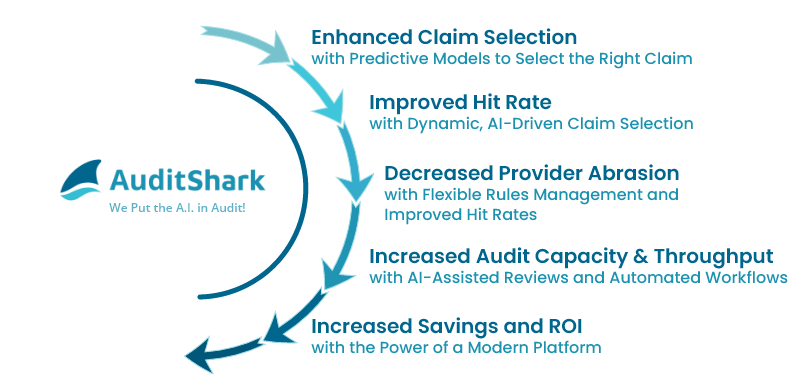

AuditShark is the first complete platform dedicated to payment integrity audit professionals, designed to help health plans easily scale their internal audit capabilities.

Only AuditShark has all the major audit types on a single platform, empowering health plans to reduce point-solution fatigue and the costs of integrations and get more out of their investments by leveraging the same platform across the enterprise.

What could faster Audit Reviews

mean for your team?